When a supply Is not the Most readily useful Tip

Crossbreed Fingers

Crossbreed Hands start with a predetermined-rates ages of any where from about three to help you a decade. Then, he has got a variable months in which the speed get changes in respect so you’re able to a directory.

With these mortgages, the first interest rate may be lower than fixed rates mortgage loans. The fresh smaller new introductory period, the lower the rate could be.

Talking about printed in a design where in fact the first matter determines enough time of the fixed speed additionally the 2nd count the new lifetime of the rest loan. Instance, 5/twenty five Case means a fixed speed of 5 age with a floating rate getting 25 years. A good 5/1 Arm might have good 5-12 months repaired price immediately after which to improve every year after that.

Interest-just (I-O) Case

Interest-simply Hands require you to only pay appeal into the financial to own a-flat date (3-10 years). After that timing, then you definitely start to spend for the dominant and you can appeal of the mortgage.

This one would-be ideal for those who actually want to save money on a few several years of the financial, to make sure he’s got loans for something else entirely. Although not, going for an extended I-O several months setting your repayments was high immediately following they finishes.

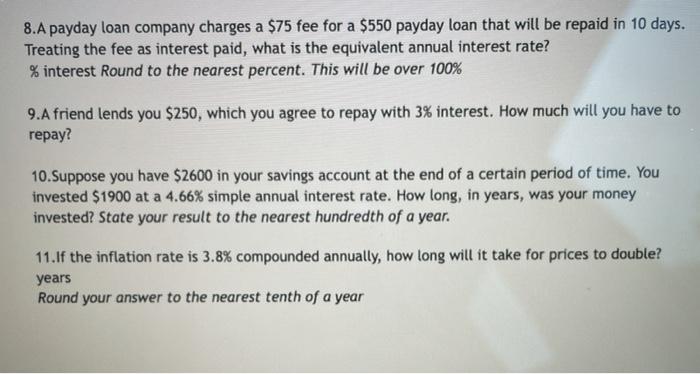

Payment-option Arm

![]()

- Pay for the principal and you can appeal

- Pay down just the interest

- Shell out at least count that will not security appeal

Even though it ount or just the desire, you are going to in the course of time need to pay the financial institution straight back everything because of the the specified day. The new expanded you’re taking to repay the principal, the better the attention fees are. Brand new offered you only pay off just the minimal, the greater amount of the brand new costs develop.

When a supply is effective

Is a supply most effective for you? For some homebuyers not as much as certain things, an arm could be the wise monetary alternatives.

It’s not Your Forever Family

Once you know our home youre to shop for is certainly one you want to get-off in a few age, following an arm ple, if you are planning to maneuver of condition otherwise purchase an effective the home of satisfy your current (rather than future) demands, upcoming thought an arm. Might score a low introductory fixed rate, following you can expect to sell our home before the interest rates had been adjusted.

Quickly Pay back Home loan

While most mortgage loans is actually for 15 otherwise 30 years, you can indeed pay it back shorter. If you plan to blow a off quicker, then you may spend less. If you know you’re getting an inheritance, bonus, or other financial windfall, then you could once again spend less on lowest basic rate. It is smart to know you can get the required money up until the avoid of the fixed-rate several months.

Low Initial Money is actually Priority

Adopting the very first fixed rate, the new advice of adjustable-rates https://paydayloancolorado.net/gold-hill/ mortgages isnt foreseeable. The fresh new benchmark could shed, decreasing interest levels. not, it would likely boost and you will end up in interest levels to help you go up. There is no answer to predict that it with full confidence.

However, if the low initially pricing is actually their concern and you’re okay into chance of large repayments after, next a supply may be a great fit. An alternative trick benefit of the low speed is you can shell out much more with the the main initial, making it possible to lower your loan equilibrium from the way more for individuals who like.

Whenever you are Hands possess its spot for particular homeowners, they may not be always the most suitable choice. The first lowest costs try appealing, in addition they can make it easy for you to receive a good bigger loan for a house. But not, changing costs try difficult for budgeting. The newest repayments can alter significantly, which will place you in financial trouble.

Leave a Reply

Want to join the discussion?Feel free to contribute!