What to expect once you apply for a personal loan

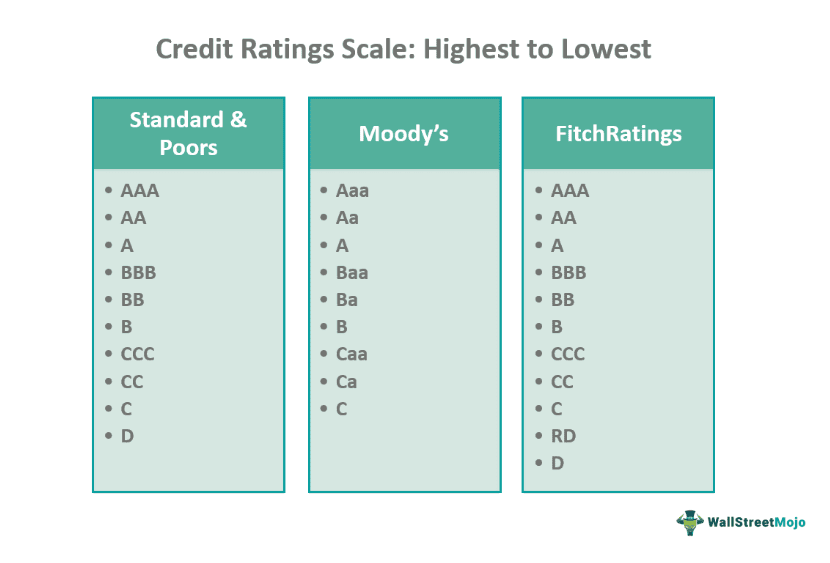

Since the house collateral loans are covered that have security, it is essentially simpler to be eligible for financing. That is not how unsecured loans work. Personal loans are typically personal loans that do not want collateral, which means your credit rating and you will earnings history you will enjoy an effective more critical character when being qualified for a financial loan. Essentially, the better your credit rating, the reduced your very own mortgage rates.

Immediately following a loan provider approves your loan, they normally put the income into your family savings. If you’re utilising the loan to help you consolidate the debt, your own lender may possibly agree to repay creditors truly.

When you sign up for a consumer loan, the financial institution will eliminate your credit to review debt background. It borrowing eliminate is known as a painful inquiry, and therefore usually lowers your credit rating by several facts.

Because you evaluate an educated unsecured loans, remember that many loan providers will let you prequalify getting money, which generally leads to a smooth $255 payday loans online same day Alaska borrowing from the bank pull that does not impression your credit rating.

Positives out of a personal bank loan

- You reside not at stake: In case the worst goes and you default on your own financing, they probably will not apply at what you can do in which to stay your property.

- Punctual acceptance: You can usually rating a consumer loan quicker than simply a property guarantee mortgage, constantly within a few days and sometimes in minutes.

- Best to have lower amounts: There is no feel experiencing the full underwriting means of an excellent family guarantee mortgage having $5,000. Personal loans become better if you are credit a little sum of money.

Downsides from an unsecured loan

- High interest levels: Since unsecured loans is actually unsecured, sometimes they bring higher rates of interest than just home guarantee fund.

- Much harder to help you meet the requirements: Rather than equity, banking companies would be less happy to take on dangers. As a result, individuals that have worst or reasonable borrowing could find it much harder to be eligible for a consumer loan.

- Straight down borrowing numbers: You will possibly not have the ability to borrow as often which have a great consumer loan as you create with a home security mortgage. Signature loans hardly meet or exceed $100,000. Concurrently, house guarantee finance you will will let you use significantly more than simply that if you have sufficient equity.

Household security loan vs. personal loan: Which is the better option?

To determine if or not a property guarantee financing or a personal bank loan is advisable for your requirements, imagine per loan’s enjoys as they relate to your debts.

Fundamentally, a personal bank loan will likely be a good idea just in case you features a strong credit history and require use of the funds rapidly. A consumer loan will be a much better alternative if not individual a property otherwise you are a different sort of homeowner exactly who has never yet , collected significant security.

An unsecured loan may additionally make more sense for people who own a property when you look at the a place in which home prices are flat or dropping. In such a case, it probably would not sound right to locate a property guarantee financing in case your mutual financial balance do exceed their residence’s actual worthy of.

Additionally, if you are a resident with large equity in your home, a home guarantee financing could be worth taking into consideration. That is particularly true if you prefer a loan amount more $100,000, that’s unusual discover with an unsecured loan.

Which is greatest, a house equity financing or an unsecured loan?

Deciding anywhere between a home collateral loan otherwise an unsecured loan usually come down towards the monetary expectations. Such as, if you like large credit wide variety and you will less interest rate, a property guarantee financing might be the better bet. not, if you would like a smaller amount however, have to have the currency rapidly, a consumer loan is probable your best alternative.

Leave a Reply

Want to join the discussion?Feel free to contribute!