Virtual assistant fund against. antique fund: Deciding to make the correct choice

An advance payment are confirmed with many antique mortgages. Although not, there are certain antique loan alternatives for as low as 3% off. Just remember that , a smaller sized advance payment normally end up in individual financial insurance coverage (PMI). For folks who set-out anything lower than 20%, expect financial insurance to appear in your costs.

Individual financial insurance

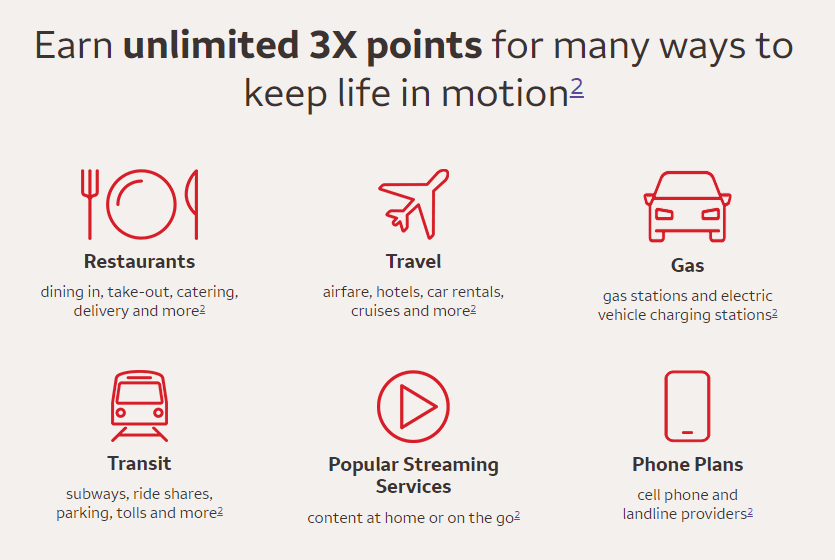

A lot of fund require individual financial insurance rates to safeguard the lending company incase the latest debtor non-payments. Va financing let you off of the insurance hook up, if you’re old-fashioned fund commonly tack about charges. Although not, it is possible to bypass it.

Virtual assistant finance dont make you buy mortgage insurance policies, nevertheless can not totally refrain charges. Alternatively, Va money request an initial money fee of 1.25% to three.3% of one’s count you may be credit. Exactly how much possible spend relies on extent you put off and when you’ve utilized your own Va mortgage pros on early in the day. If you get Va handicap compensation, you don’t need to pay the financing fee at all.

For people who set out lower than 20% to the a normal financing, individual financial insurance rates (PMI) usually kick in. Your credit score and you can down payment matter determine how much you’ll be able to owe. According to Freddie Mac, you are going to shell out $29 in order to $70 monthly for every $100,000 borrowed.

Credit history conditions

A solid credit history is definitely the great thing since it helps you get a lesser price and higher words. In the event the score is actually lacking, an excellent Va financing is more planning offer the green white.

Va loans

The newest Virtual assistant itself doesn’t request a particular credit rating, but for every bank has its own rules. Lenders usually aspire to pick a rating regarding 620 or maybe more to have Virtual assistant fund. In the event the your own is gloomier, you should never matter your self out. Some lenders will accept credit ratings only 580 and you can need most other monetary things under consideration, just like your debt-to-money ratio, work record and you may a sparkling declaration card from prior homeownership.

Antique loans

Traditional loans are not very more right here. Most lenders like to see a credit score with a minimum of 620. Whether your credit history does not smack https://simplycashadvance.net/payday-loans-wa/ the draw, you will probably possess top chance qualifying which have an excellent Va mortgage, with delicate constraints.

Debt-to-earnings (DTI) ratio

With the credit score, your debt-to-earnings ratio is where loan providers dimensions up your financial health. Which proportion talks about simply how much of the terrible monthly earnings happens into month-to-month loans repayments such as for instance auto loans and you may borrowing cards.

What if your draw in $5,000 1 month but purchase $step 1,five hundred repaying loans. That’s a thirty% debt-to-income proportion. The low the DTI, the greater the probability is of qualifying for a loan and nabbing an aggressive interest.

Want to lower your DTI ratio before applying? Manage paying down your current financial obligation and prevent using up people new types of debt, if or not you to definitely be a charge card or vehicle repayments.

Va loans

The fresh Va doesn’t set hard-and-fast rules to DTI, but loan providers fundamentally try not to love rates more than 41%. Certain loan providers allow you to squeak because of the with a proportion just like the large as the 60%, however, which comes with a more thorough underwriting procedure .

Antique finance

Conventional finance can serve up a blended bag. Most loan providers want to see a proportion out of thirty-six% or below while others are willing to take on rates once the high while the 43% if not fifty% in many cases. Complete, if you have a premier DTI, a great Va financing may be the better choice.

Given that we’ve got shielded the fundamentals, it is the right time to imagine and that mortgage is the better complement. When you are noodling towards Va funds compared to. traditional funds, the selection boils down to your needs and you can what you are lookin to have. Why don’t we get stock of your own variables you should look at.

Leave a Reply

Want to join the discussion?Feel free to contribute!