Threats regarding the failing to pay the HELOC

- For folks who discovered a tax refund at the end of the fresh new year, incorporate the complete amount to the principal of your HELOC.

- If you get a plus at the job, consider putting it on to your financing.

- Prevent rolling the newest closure cost of the HELOC into the balance (like that, you’re not repaying interest with the costs, too)

This can help you make borrowing from the bank throughout the years

You can find risks associated with failing to generate costs timely. It is usually best for individual money objectives to spend your own HELOC financial obligation timely monthly. If you it, good HELOC works for you, assisting you reach finally your requires. However, for folks who get behind, a couple of things can take place:

- It might harm your credit rating. The lender reports missed costs for the credit reporting agencies, that will decrease your rating.

- Shed costs as well as produce charge, contributing to the principal and you may total cost.

- If you can’t pay your loan and don’t explore a home loan re-finance solution or any other financing to pay off the brand new harmony, the financial institution is also find suit facing your house. Remember, this is exactly a protected loan supported by the value of your own family.

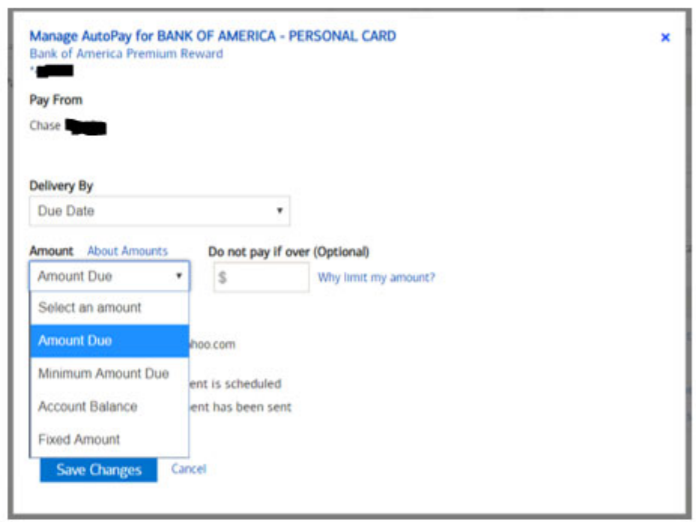

Created electronic financial and automated costs, and pay more you borrowed from per month so you’re able to continuously stand towards the top of your own HELOC mortgage.

Utilizing HELOC Financing

Property Collateral Personal line of credit (HELOC) should be a strong tool for funding do-it-yourself projects. Of the leveraging the security of your home, you can access loans to help you change your assets, and thus increasing the worth. Regardless if you are seeking to renovate your kitchen, put another type of toilet, otherwise boost your backyard living area, speedycashloan.net payday loans open on sunday near me a great HELOC contains the autonomy and you will financial resources to make their do-it-yourself hopes and dreams towards the fact. Investing in high quality improvements advances your own way of living ecosystem and you can potentially boosts your own residence’s market price, so it is a sensible economic relocate the long term.

If you’re dealing with higher-notice obligations, such as for instance handmade cards or personal loans, an effective HELOC can offer a practical services having debt consolidation. Using a good HELOC to repay existing expense, you might decrease your overall interest rate and express your finances having an excellent consolidated monthly payment. This tactic could save you cash on attention costs which help you pay away from the debt faster. But not, it is vital to getting controlled on your own payment want to make certain that you do not collect additional debt, leveraging the low rates of interest regarding good HELOC to your advantage.

A good HELOC normally a very important resource to have financing high lives expenditures, such as for instance knowledge. Whether you’re offered time for college or university on your own otherwise financial support good baby’s college degree, the flexibleness away from an excellent HELOC might help security tuition or other expenses. On the other hand, good HELOC are used for other big expenses, eg performing a business, coating medical costs, otherwise financial support a life threatening life skills like a married relationship. Making use of the guarantee of your home, you can access fund at a lower rate of interest than many other sort of finance, it is therefore a repayment-effective option for capital high expenses.

While an excellent HELOC offer of several economic masters, it is necessary to see the risks on it. Credit up against your residence guarantee means placing your house on the line. If you can’t improve HELOC repayments, you could face foreclosure. At exactly the same time, interest levels into HELOCs are usually varying, so your payments you can expect to improve through the years. That have a good payment plan and using the money intelligently is important. Don’t use a good HELOC getting discretionary spending or high-risk assets. Consider carefully your financial situation very carefully and you may consult a professional to ensure a great HELOC is the correct solutions.

Leave a Reply

Want to join the discussion?Feel free to contribute!