The way you use Mobile gift shop $1 deposit Take a look at Deposit to have Punctual & Simple Places

One of the greatest advantages of mobile banking, and especially mobile take a look at dumps, ‘s the independency that it brings. You’re no longer tied to an actual place for a good secret element of debt requires, and many banking companies give this service for no additional fees. For example, Financial from America offers cellular view dumps and usually procedure money as offered another working day. Nonetheless, ensure that the banking app you install to do a mobile look at put are regarding the lender in itself, and never an arbitrary source, to stop potential con. Deceptive cellular applications taken into account almost 40 % of all the scam symptoms in the 2021, based on a report from the Outseer, a supplier away from payment con protection functions.

Financial from The united states Virtue As well as Financial | gift shop $1 deposit

To possess advice output needed to end up being registered on the otherwise once January step one, 2024, the fresh digitally processing demands tolerance could have been lowered to 10 total advice productivity. Go to The brand new digital filing standards to possess Models W-dos for much more details. Deposits to possess FUTA Tax (Function 940) are expected on the quarter within this that the tax due exceeds $five-hundred. The fresh taxation need to be transferred by the end of your own few days following the prevent of your quarter.

Versions & recommendations

That it functions if you have pay-as-you-go otherwise monthly obligations. Pay-as-you-go consumers will find the newest commission taken from their portable harmony, if you are payment pages will see the new charges on their next payment. Finder.com is actually a different assessment program and you may suggestions services that aims to offer information to make better conclusion. We might found fee from your affiliates to own looked placement of items.

What Financial institutions Provides Mobile View Put?

Their bank’s cellular take a look at deposit contract often outline the gift shop $1 deposit types of monitors you happen to be allowed to put. Wells Fargo cellular deposit will bring an instant, 100 percent free and safe solution to put inspections. Because of the number of almost every other helpful provides from the app, you’re likely to realize that cellular banking is sensible not merely to have deposits, however for overall account administration too. To attenuate the risk of fraud, financial institutions essentially enforce restrictions on the mobile view deposits.

If or not you choose to work on an economic advisor and create a financial strategy or invest online, J.P. Morgan also provides investment education, solutions and you will a range of products so you can reach finally your needs. Just as with a vintage deposit, there’s constantly a possibility one a check get bounce. So that the money try transported accurately, it’s best if you hold onto their monitors before the put provides removed. This way, you have the check on turn in situation one thing fails during that time.

Financial institutions generally render backlinks on the websites to have securely getting its apps. Regarding the banking community, these digital deals try described as remote deposit capture. They’lso are canned in person from bank’s electronic platform, as well as the analysis you send is protected by encryption. And, as opposed to inside-person look at deposits, you will get an immediate digital confirmation otherwise bill after and make a great mobile look at deposit.

What types of checks must i put having fun with mobile take a look at deposit?

If you’lso are being unsure of if the financial institution offers mobile view deposit, you could look online otherwise get hold of your part and someone truth be told there can let you know when it’s designed for your bank account. Most modern banks enable it to be mobile view dumps because of the respective banking software, but not are instantaneous. To get more account possibilities, evaluate the finest checking profile and best high-give deals account. Pursue QuickDeposit℠ is actually at the mercy of put restrictions and you will fund are typically offered from the second working day.

Worldwide corporate believe

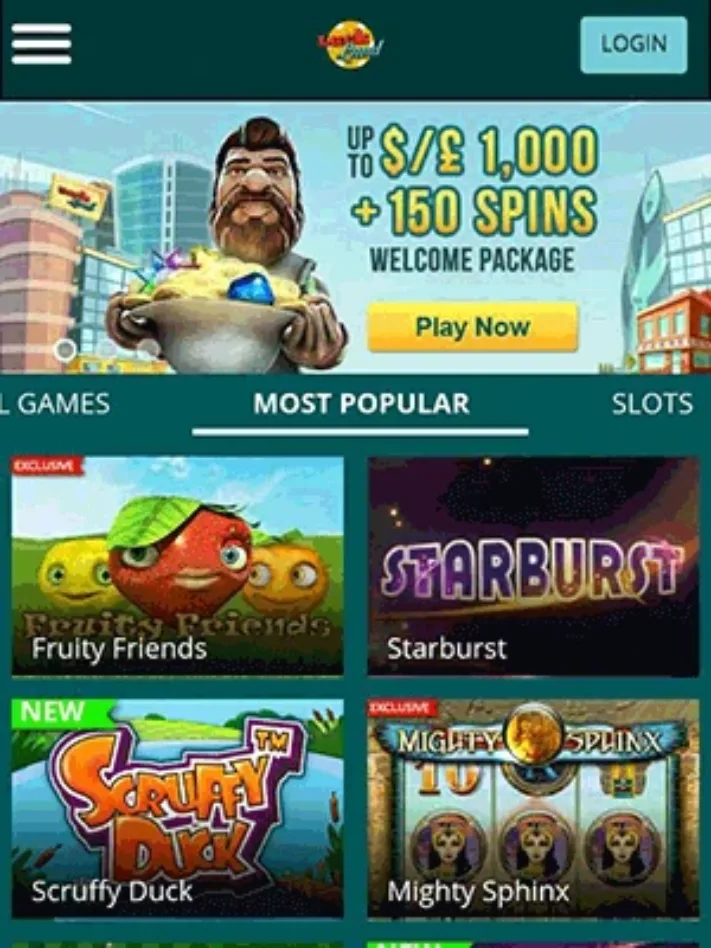

For distributions, you’ll typically need to use another strategy, for example bank transfer, e-bag, or a good debit/mastercard. It is usually smart to talk with this on line local casino you’re playing with because of their withdrawal options and regulations. Your look at deposit is complete and you will fund appear instantly, quite often; yet not, basic view retains pertain to help you mobile view dumps. Merrill offers a broad directory of broker, money advisory (along with monetary thought) and other features. You can find extremely important differences between brokerage and you can funding consultative characteristics, such as the form of information and you will direction provided, the newest fees recharged, and the legal rights and debt of the events. You will need to understand the distinctions, particularly when determining and this solution or functions to pick.

Insurance coverage and annuity products are considering as a result of Merrill Lynch Lifestyle Service Inc., a licensed insurance company and you may completely owned subsidiary out of Lender away from The usa Corporation. 1Mobile Take a look at Dumps is actually susceptible to verification and never available for immediate detachment. The brand new Inmate Plan System exists every six months while the a great way to get a dinner/hygiene bundle to possess incarcerated loved ones or family. ADC establishes a dollar limit to possess bundles purchased during the designated program episodes (constantly ranging from $100-$150).

Cardless ATMs: The way you use and you may How to locate Him or her

That have West Connection’s Quick CollectTM blue form, you just deliver the shop clerk along with your membership amount, spend which have dollars, and you may walk out along with your receipt. If you want and make payments and you may deposits thru mail, GTL welcomes monitors and/otherwise currency sales (depending on the facility) through Us Postal Provider mail to have features and institution the following. 2TD Bank Cellular Put is available to Users that have a dynamic examining, discounts otherwise currency business account and using a backed, internet-allowed ios or Android device with a camera. Properly take control of your TD Financial individual and you will small business account away from the mobile or pill on the TD Lender app. Review all the details you’ve published to make sure that it’s precise. Complete your own view and you will wait for confirmation to find out if it is approved.

Find The Business Lower than

Excite write to us where you financial therefore we can give you exact rates and you may percentage advice to suit your venue. Money Order/Consider put versions was found in studio lobbies and available to have users so you can printing off of the websites from the Availableness Alterations. Terms of use governing access to GettingOut characteristics believe that all the services are designed to be used by the persons across the decades away from 18. The the new each and every minute “pay as you go” model function you are recharged just for enough time your talk. Therefore regardless of where you’re – performs, chapel, if not unavailable – their inmate can still make you a message.

Deposits stored more than a-year try paid back desire considering average productivity set for 10-seasons securities. The new deposit relies on the brand new questioned quantity of your online business utility use, your credit rating or any other issues placed in the brand new utility’s authored deposit coverage. A digital collaborative must pay interest on the buyers deposits only when the fresh cooperative’s bylaws want players to spend costs which are not covered by power rates billed within the year. Today you’re prepared to include your own deposit(s) on the top deposit plan in the Scotland. Complete the deposit security setting on the information expected to protect the newest deposit, such as the tenancy address, put matter and you will tenants’ info.