Journal Entry Practice Quiz

Accounts receivable decreases when the customer pays the company. (a.) & (c.) are recorded with a debit to accounts receivable. D. When writing a journal entry you write the debit on top and the credit on bottom. Total debits must equal total credits, which will keep the accounting equation in balance. Prepare “T accounts” for eachbalance sheet account and prepare a balance sheet.

Which journal entry will VC Consulting make for Victor Cruz’s contribution of $78,000 in cash and $146,000 in land?

You should have written a T account for each account name used, posted the amounts on the proper debit or credit side and balanced each account. You should have written a T account for each account name use and post the amounts on the proper debit or credit side and balance the account. I’ve put together a question pack covering Journal Entries.

What will be the total stockholders’ equity reported for Apple Photography after the January transactions?

Accrued expense is the liability often used for advertising expense (accounts payable is also used). D. Payments are always a decrease to cash which is recorded with a credit. If cash is the credit, the other account must be a debit. Dividends paid is a decrease to the owner’s equity account retained earnings or dividends paid (either can be used).

- Increasing a liability is recorded with a credit.

- B. A debit to investments is an increase in investments.

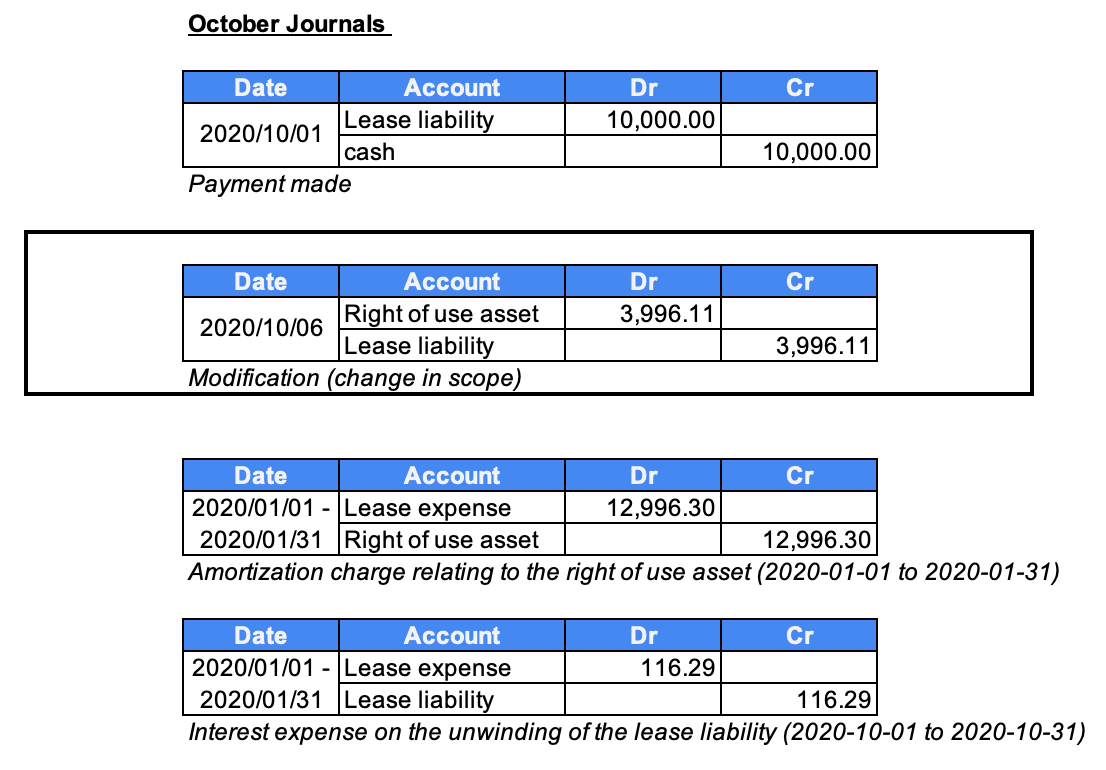

- Below is a brief summary of these transactions and journals.

Hard Practice Test

Imagine not being stressed out while taking your test! You’ll become more efficient at answering these questions correctly, so you’ll feel calm, and confident while taking your test. Determine the balance in the cash account at the end of the first month. A current asset representing the cost of supplies on hand at a point in time. The account is usually listed on the balance sheet after the Inventory account.

Latest Accounting Quizzes

Paying later increases a liability, credit (not one of the choices). B. Debits to an asset (left/top) represents increases. Total debits will equal the total amount of increases to the asset.

What journal entry will a law firm make to record collecting $3,200 in advance?

Not yet received is a receivable which is an asset. One could thus follow information from the journal entry to an account in the ledger, or vice versa. A recording in one of the journals is called a journal entry. Of course, these days bookkeepers enter transactions in an accounting program on the computer. So these books of first entry are now just in digital form. They are chronological accounting records, each one composed of a debit and a credit.

Cash is increased (debit) and accounts receivable is decreased (credit); both are assets. This is the journal entry for when a business makes income but does not receive the payment accounting for derivatives definition, example for this straight away. Accounts receivable is recorded (this is also known as receivables or debtors). This is an asset account representing the amount of funds owed to us.

D. A journal entry must always have equal debits and credits. The answer must contain a debit and a credit. The asset land increases with a debit.

Leave a Reply

Want to join the discussion?Feel free to contribute!