How-to sign up for a home collateral mortgage otherwise HELOC in the event that you are worry about-functioning

In case the mind-a position earnings was variable, you could be more secure to the liberty regarding a beneficial HELOC. Once you aim for something, check around to have a loan provider. Its smart to research and find a loan provider we would like to run. Before choosing a loan provider, evaluate consumer product reviews to make certain it does do the job.

- Interest rates

- Commission structures

- Running moments

- Mortgage terminology

- Potential savings

Lenders have novel techniques for verifying income. See possibilities that offer methods in addition to pay stubs and you will W-nine versions and you will examine rates. Specific lenders can charge a high rate for consumers who are self-employed to let decrease the risk of inconsistent money. But it is perhaps not a tip across-the-board, therefore evaluate the loan quotes to determine the best choice.

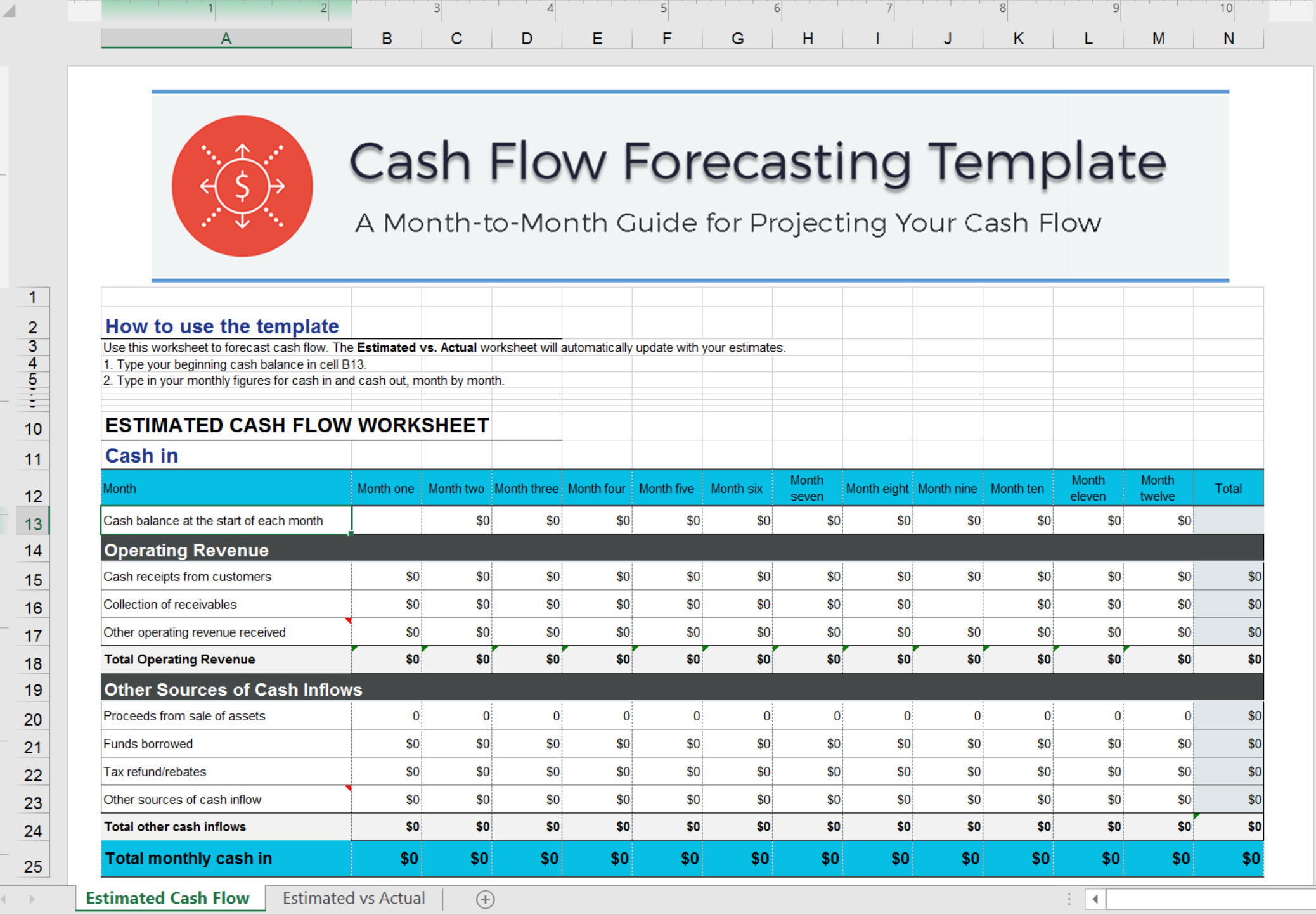

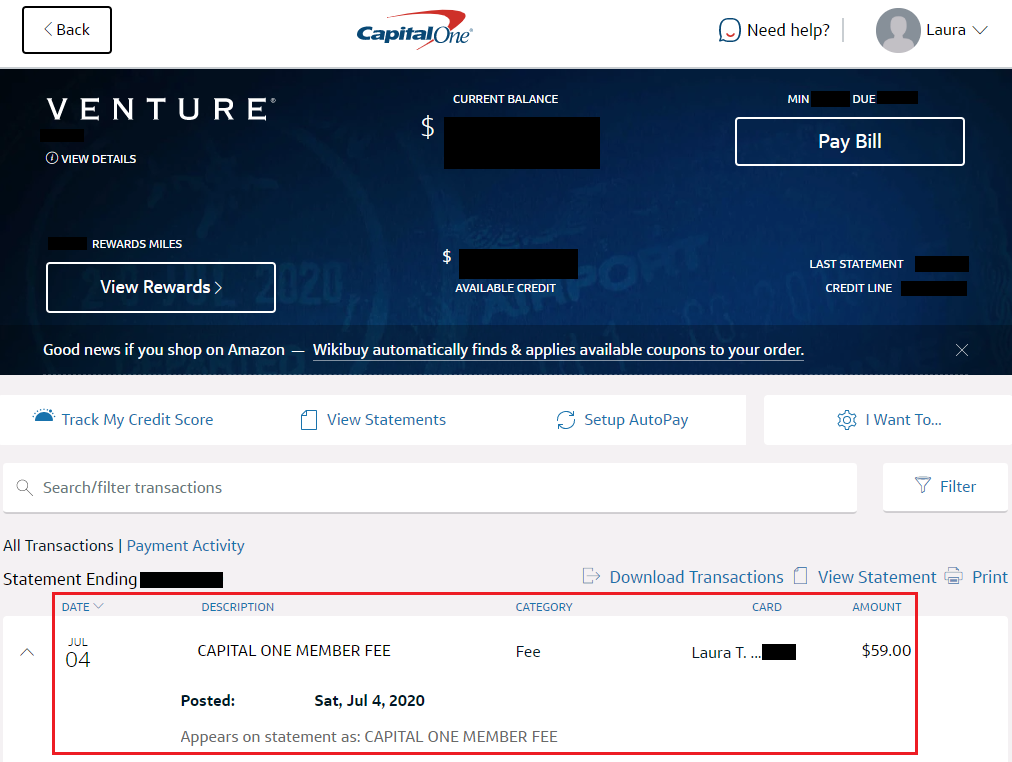

Shortly after https://elitecashadvance.com/installment-loans-tx/riverside/ buying a loan provider, you can assemble your details for your application. This often has personal and economic pointers as well as your residence’s projected worth. Needed economic data start from personal and you can team lender statements and tax statements.

Then you’ll need your residence appraised (your lender have a tendency to program it), and this will over a challenging credit assessment. Here are some our lookup towards the ideal household guarantee loans and you may ideal HELOCs.

Providing an excellent HELOC otherwise home equity financing to have worry about-working some one demands much more comprehensive files than just when you yourself have a great more traditional job.

Like an usually operating debtor, you’ll need to prove your see your lender’s HELOC criteria and you will have the method for take on and you may pay-off this new debt. To achieve this, you might have to offer a mix of another:

- Current financial comments (at least multiple months’ well worth)-might be individual and business when you yourself have independent account

- Organization and private tax statements for the past a couple of years

- An announcement from your own accountant verifying their company’s wellness

- Team development data files and you may proof ownership (unless you’re a sole owner)

Your financial allow you to know in the event it demands additional income suggestions during the application process. You should also be ready to complete homeownership and property insurance policies details.

Apart from differences in the latest papers with it, the home security money app procedure is the identical having self-operating and generally functioning borrowers. Given that family equity funds and HELOCs try personal money, ensure that the funds is deposited in the individual checking account, perhaps not a business account.

Approval and financial support timelines vary by bank. Bringing property guarantee financing otherwise HELOC isn’t as prompt due to the fact taking a charge card, nonetheless it shall be reduced than of several business loans, like SBA fund. Enjoy the method to take from around two weeks to a couple weeks from when you apply to when you have access to your own finance.

Solutions in order to HELOC otherwise domestic equity mortgage to own a personal-employed borrower

When you find yourself concerned about your odds of acceptance whenever you are notice-employed-or if you removed financing and you may was in fact refuted-you will be able to secure financing with your HELOC choice:

Cash-away refinance

A cash-aside refinance will provide you with immediate access in order to more money by replacement their home loan having a bigger that. You are able to pay back a unique, big mortgage in exchange for extra money on your pouch. You could potentially often find a lowered rate of interest which have a funds-aside refinance than property security loan otherwise HELOC.

Home security discussing agreement

A home guarantee sharing arrangement, otherwise domestic equity resource, gives a financial investment organization a fraction of your own equity reciprocally to have a lump sum. In lieu of HELOCs and you can domestic equity funds, a home guarantee shared contract isn’t a form of financial obligation, it should be better to meet the requirements.

Leave a Reply

Want to join the discussion?Feel free to contribute!