Shared regarding Omaha Family Equity Personal line of credit

Transfer Your residence Guarantee to Bucks

- Records and you may Background out of Shared out of Omaha Mortgage

- Cash-Away Re-finance compared to. Home Security Credit line: What’s Top?

- Why does the Shared out-of Omaha Household Security Credit line Functions?

- The advantages of Providing a property Equity Personal line of credit having Common out of Omaha

- What can You use the cash away from a house Security Range off Credit regarding Mutual off Omaha For?

- That is Qualified and you may What do You need to Pertain?

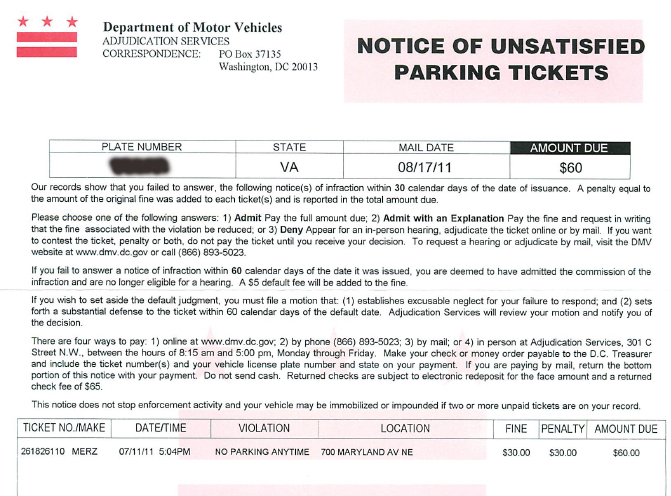

- What are the Will cost you and you may Fees off a common from Omaha Household Collateral Credit line?

- How to Apply for a house Collateral Line of credit which have Mutual out of Omaha

Domestic security loans will be a valuable economic device for property owners seeking to accessibility the fresh collateral built up within their assets. These loans enables you to utilize the residence’s collateral, that can be used to own motives anywhere between renovations in order to debt consolidation reduction otherwise investment a hefty costs, for example studies otherwise a marriage. This type of finance generally speaking offer all the way down rates versus other types out of credit, because they’re secure by the property. Read more