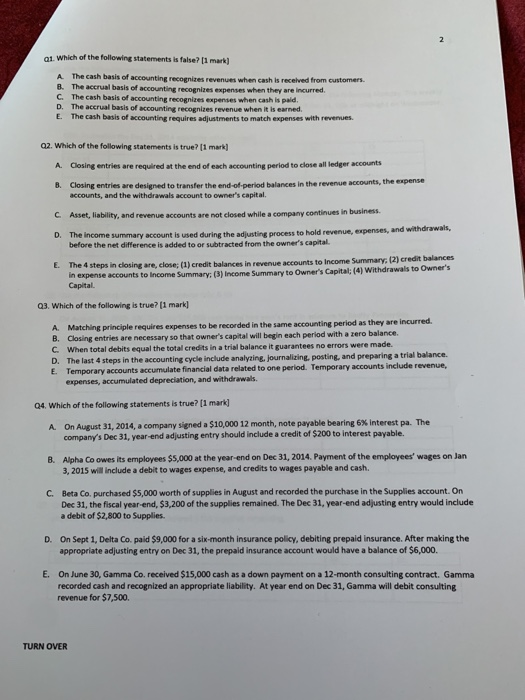

Were prisoners: 3% financial pricing is actually a blessingand you will a beneficial curse

And even though securing in the fixed home loan cost ranging from dos% and you may 3% is considered to be a large economic earn, specifically given that pricing was hovering a lot more than six%, also, it is just a bit of an encumbrance. Specific people, just who closed in the over the years low cost inside the pandemic, are actually impression swept up, or as a whole resident tells Luck: Our company is prisoners. They’d desire to promote their home and purchase something else; however, elevated home loan pricing indicate the increased month-to-month homeloan payment to accomplish so might be economically unbearable.

He would need to flow, but after handling their agent and you may large financial company to place off an offer on the a more impressive family, Noguera knew it wasn’t feasible

Take a look at Jennifer Lovelace. This new 38-year-dated realtor and holder away from a region browse university into the St. Read more