3.Exactly how protection agreements keeps aided creditors into the real-lifestyle problems? [Brand-new Site]

One of the most important benefits of a security agreement for creditors is that it provides them with a legal recourse in case the debtor defaults on the loan. A security agreement gives the creditor the right to take possession of the collateral that secures the loan and sell it to recover the debt. This way, the creditor can minimize the risk of losing money and protect their interests. In this section, we will look at some case studies and examples of how security agreements have helped creditors in real-lifestyle issues.

The financial institution looked for in order to foreclose towards security and take more than the bistro procedures

1. In 2019, a company called Lendy Ltd, which operated a peer-to-peer lending platform, went into administration after against financial hardships. The company had lent money to various borrowers, secured by property and other assets. However, many of the loans were overdue or in default, and the company was unable to repay its investors. The administrators of Lendy Ltd were able to use the security agreements to enforce their rights over the collateral and recover some of the funds owed to the investors.

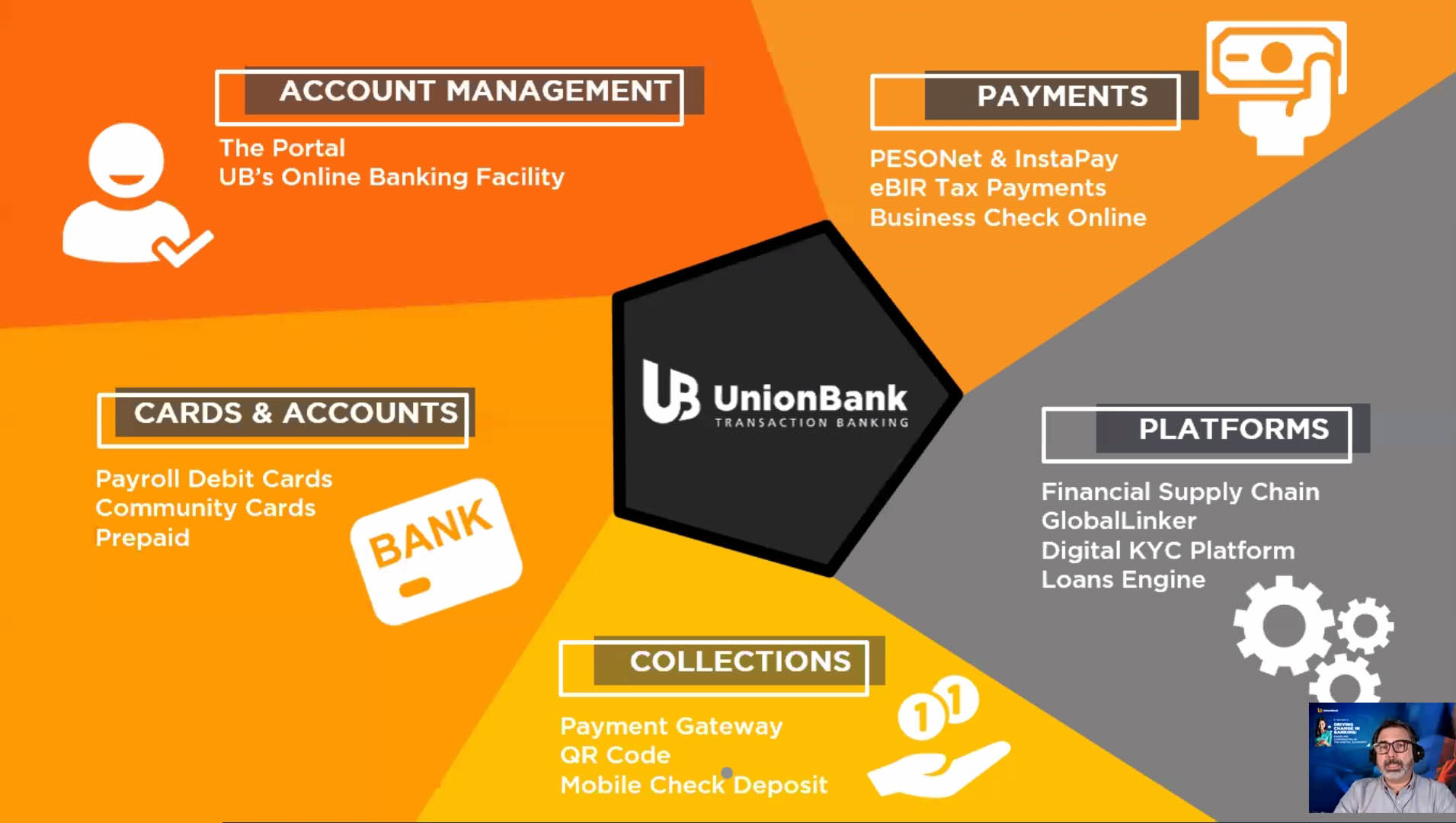

dos. During the 2020, a lender entitled Wells Fargo prosecuted a restaurant strings named NPC Globally, hence work numerous Pizza pie Hut and you can Wendy’s shops, to own breaching their loan covenants. The bank said that NPC Global got broken the fresh new terms of their $step 1.cuatro million personal debt by the attempting to sell a few of its possessions without any bank’s concur. The bank along with alleged one to NPC Around the world got don’t maintain its features and devices in good shape, hence reduced the value of the newest security.

3. In 2021, a company called Hertz Global Holdings, which operated a car rental business, emerged from bankruptcy after reaching an agreement with its creditors. The company had filed for bankruptcy in 2020, after being hit hard by the COVID-19 pandemic and losing most of its revenue. Read more