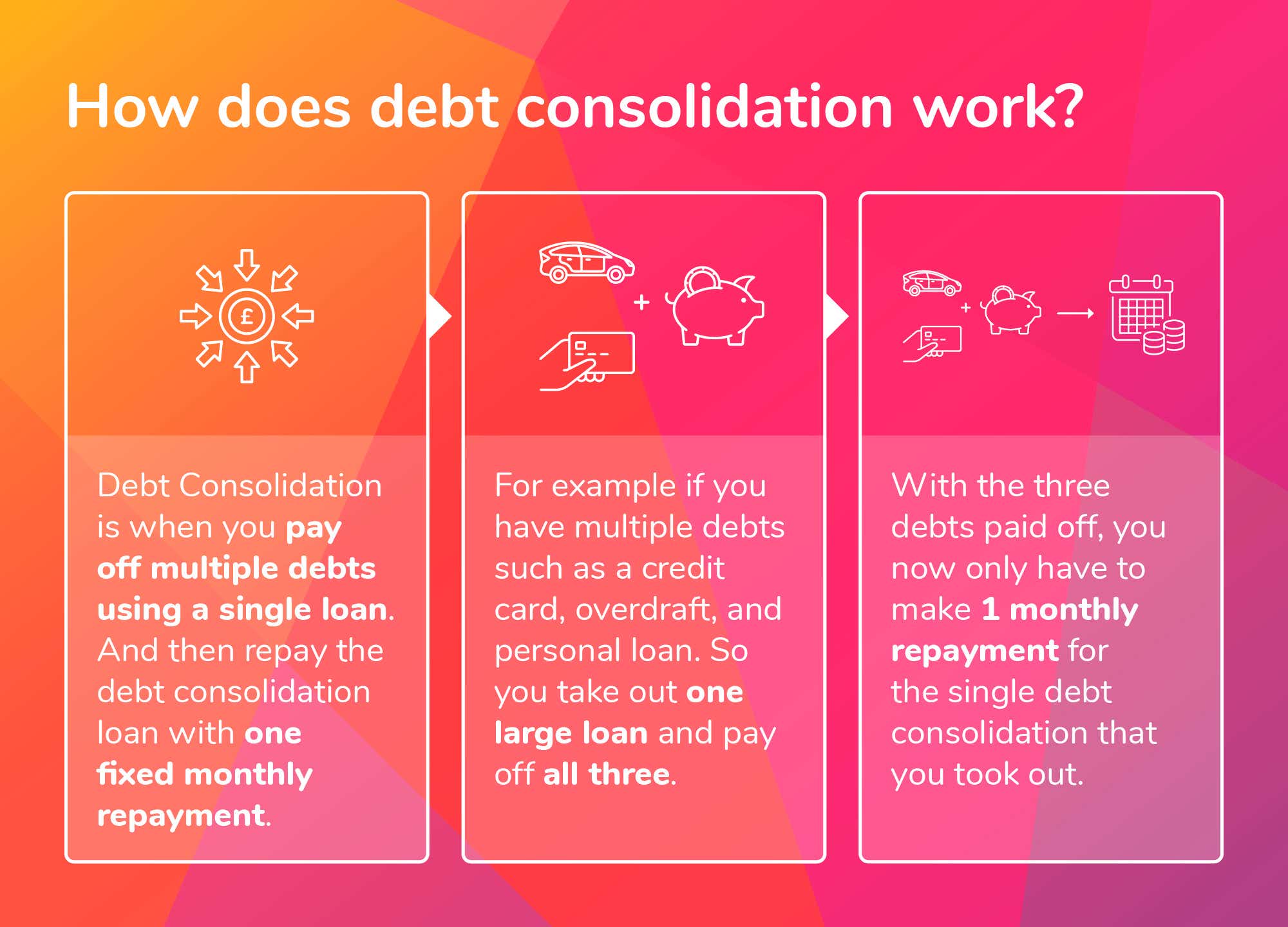

A customer sales an effective $500,000 home with a deposit out-of $100,000 and you can an effective readvanceable home loan off $400,000

- a beneficial $300,000 5-12 months repaired name mortgage, amortized more 25 years

- good $100,000 HELOC having interest-just repayments

Since individual will pay along the a good prominent on $3 hundred,000 label mortgage, the brand new readvanceable mortgage try rebalanced, performing more available HELOC credit.

- repaired price financial

- changeable rates financial

- blended title or price

- improved credit limit on the HELOC

- line of credit

- company personal line of credit

- mastercard(s)

4.step one. Over-borrowing

Due to the fact daunting almost all customers remain their HELOC inside a good status, the majority are performing this by simply making minimal commission (i.e., interest-just payments) or and make merely periodic perform to minimize the principal. Research indicates you to definitely roughly 4 during the 10 people do not create a routine fee against its a good HELOC principal, and you will 1 in 4 simply safeguards the eye or make the lowest payment. Footnote twelve

HELOC individuals are able to find by themselves for the a good house equity removal debt spiral, such while in the episodes regarding monetary stress. Certain loan providers industry HELOCs as the a supply of emergency money you to can be used to cover unanticipated costs or a loss of earnings. When people borrow on their residence collateral and also make ends fulfill, they are in danger of having to recuperate a great deal more equity down the street just to cover the minimum money to their HELOC. This development of conduct can lead consumers to enhance their debt obligations during attacks of economic worry in the place of reining when you look at the discretionary purchasing.

4.dos. Obligations persistence

The brand new evergreen character away from HELOCs can get foster personal debt dedication. HELOCs are produced, and often ended up selling, while the lending products that enable users so you’re able to acquire large sums out-of money up against their residence guarantee, with little to no or no obligation to settle they from inside the a fast manner. For the majority readvanceable mortgage loans, the amount of rotating borrowing from the bank open to users because of the HELOC grows automatically as they lower the primary of its amortized home loan account, and therefore revolving credit stays readily available forever.

In addition, brand new fast escalation in home cost in some places may have pretty sure particular people that HELOC cost strategies was way too many, since the security growth that can originate from coming speed expands could be offered to pay off the principal after they offer its domestic. Footnote 13 Every lenders assessed didn’t directly track how much time they grabbed borrowers to fully refund its HELOC, but individuals who did showed that the enormous almost all HELOCs weren’t totally repaid up until the user ended up selling their home.

At the same time when individuals are carrying listing quantities of financial obligation, the latest work from HELOC debt will get place after that pressure on the economic really-are regarding Canadian house. Higher quantities of personal debt can make it harder getting family to cope with unforeseen lifestyle situations instance a loss of earnings otherwise unforeseen expenses. This new stretched users bring loans burdens, the greater the probability that they’re going to strive even if away from a bad macroeconomic enjoy (elizabeth.g., petroleum rates amaze, monetary market meltdown or interest hike).

4.3. Wealth erosion

New exchangeability and easy accessibility household guarantee developed by HELOCs normally negatively affect the element of some center-classification parents to save money and you can gradually accumulate money. Paying the loan towards family home is an important click for more info an element of the mediocre household’s advancing years approach. Traditional mortgages work given that pressed savings automobile. And then make typical principal and you may desire money towards amortized mortgages allows family members so you can slowly accumulate a lot more equity in their house along the path of its functioning lifetime. Mortgage payment was an especially extremely important coupons vehicles into the average middle-classification family members within the Canada, since their wealth is concentrated within the construction assets and their economic holdings at later years is restricted. Footnote fourteen

Leave a Reply

Want to join the discussion?Feel free to contribute!